Sanganak Features

14 Mathematical Option Strategies

Sector Performance

Market Range

Fixed Time Trades

OI Data

Market Sentiment

Sanganak Users

Intraday Traders

Option Traders

Equity Traders

Open Interest Traders

Swing Traders

Scalping Traders

MATH HAI TO MUMKIN HAI

All strategies in Sanganak are developed using mathematical strategies which rely on rigorous statistical and quantitative analysis. These strategies use historical and real-time data to recommend informed trades. By analyzing large datasets, Sanganak uncovers correlations and relationships that are exploited for profit. We incorporated sophisticated risk management techniques which help in minimizing downside risk and preserving capital during market downturns. All mathematical strategies have been back tested using historical data to validate their effectiveness. Institutions and hedge funds often employ teams of quantitative analysts (quants) who specialize in developing and refining mathematical models. Now you have the same advantage!

CONTROL UDAY CONTROL

All Sanganak strategies rely on data-driven decision-making rather than gut feelings! This makes it easier to stick to the plans even during volatile market conditions. By following a pre-determined set of rules, we can avoid impulsive decisions influenced by our fear or greed. All strategies provide clear entry and exit points, reducing the stress of uncertainty. This disciplined approach fosters consistency and confidence, as you can trust the systematic process. Ultimately, Sanganak offers a structured framework that helps you manage your emotions and make rational, objective decisions making your trades as efficient as a machine. No more FOMO, No more GREED, No more Fear!!!

TU BAS LIKHTA JAA

Sanganak is equipped with the most inclusive journal ever. It provides a clear record of all transactions, enabling traders to review their past trades and identify patterns or recurring mistakes. This reflective process helps improve decision-making skills by learning from past experiences. It promotes accountability and discipline, as you are more likely to adhere to the strategies when you know you must document your actions. It also assists in evaluating the effectiveness of different trading strategies, offering insights into what works best under various market conditions. Moreover, it helps in tracking emotional responses to trades, allowing you to recognize and manage your emotional triggers better. Additionally, a well-maintained journal serves as a valuable tool for performance analysis, enabling you to set realistic goals and measure progress.

NAYA HAI YAHAN

Sanganak is the only place where you will find the best strategy for Fixed Time Market. Fixed Time Market (FTM) is a unique trading environment where trades are executed within a predetermined time frame. Unlike traditional markets where trades can be held indefinitely, FTM requires traders to make decisions and execute trades within a set duration. Sanganak offers a specialized strategy designed to maximize profitability within the fixed trading windows. By leveraging advanced algorithms and mathematical models, Sanganak enhances traders’ decision-making processes, increasing the likelihood of successful trades. Trading in the Fixed Time Market requires a disciplined approach and a well-defined strategy. Sanganak provides traders with a robust framework to navigate this unique market environment, combining technical analysis, precise timing, and comprehensive risk management.

DEKH RAHA HAI BINOD

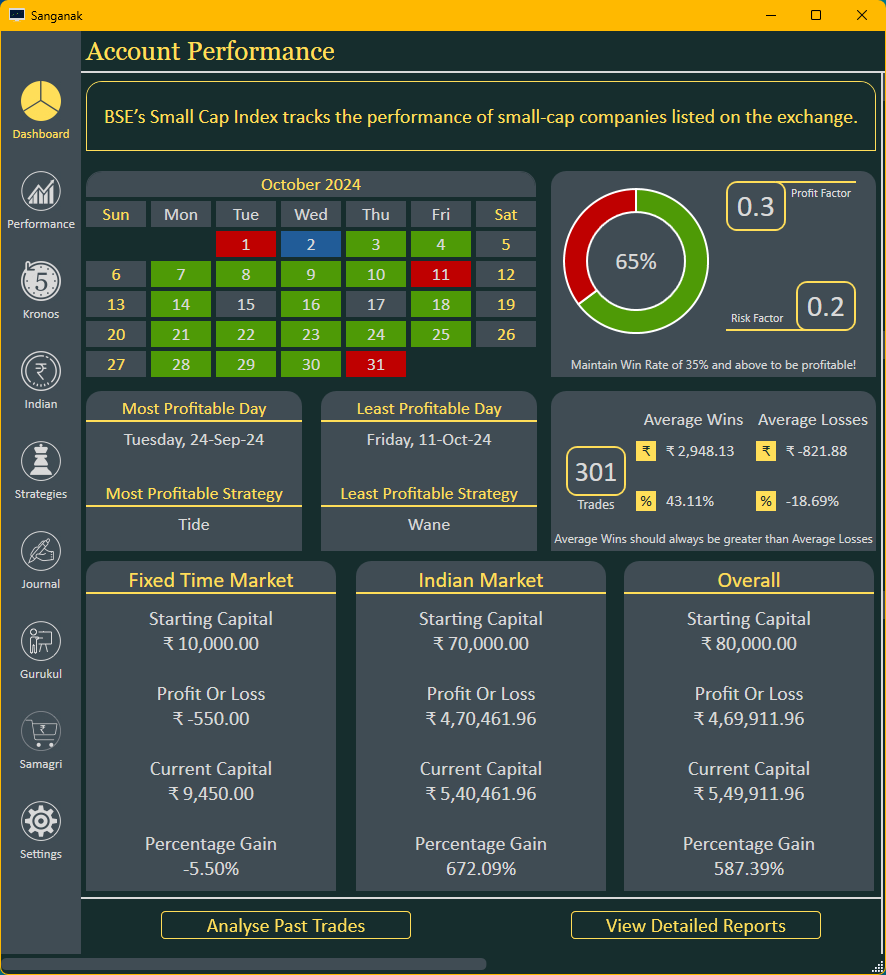

Performance management and trade analysis are indispensable components of successful trading. By leveraging detailed reports and advanced tools like Sanganak, traders can gain valuable insights into their performance, identify areas for improvement, and make data-driven decisions. Sanganak allows users to customize reports based on their specific needs. Traders can filter data by time frames, trading instruments, or specific strategies, enabling more targeted analysis and insights. Sanganak’s world-class reporting dashboard enhances this process by providing advanced visualization, real-time data, customizable reports, and comprehensive metrics. This systematic approach not only enhances profitability but also helps in managing risks effectively, ensuring long-term success in the trading arena.

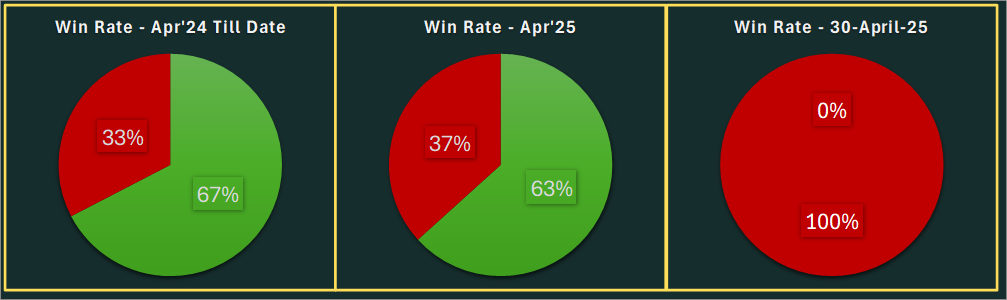

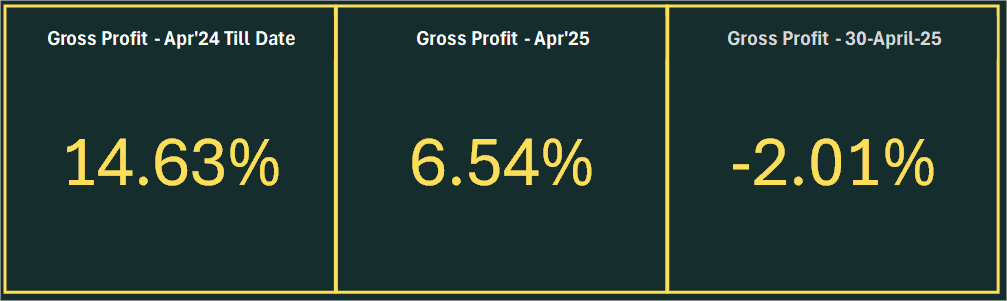

SANGANAK PERFORMANCE

To know more about the trades taken from Sanganak, download the below excel file. We have records starting from April 2024 till yesterday!

Subscribe now and learn how to become a successful trader!